HENDERSONVILLE, Tennessee—The face of the U.S. hotel industry’s recovery is taking on a different look.

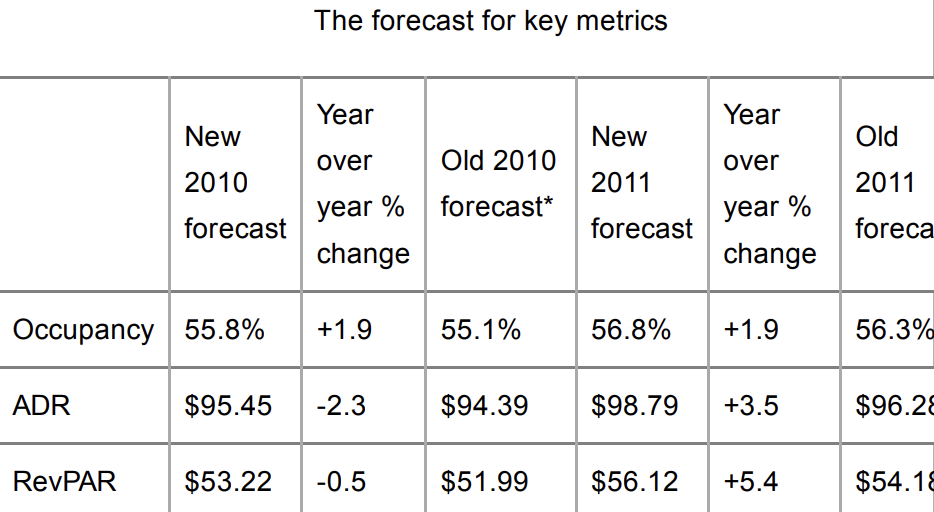

According to STR’s revised forecast for 2010 and 2011, recovery could be influenced by things such as tax changes and healthcare reform. The means a rebound will come quicker in 2010 but could get slow as 2011 unfolds.

“We think the recovery will pick up its pace during the second and third quarters of this year, then it will moderate,” said Mark Lomanno, STR’s president.

Lomanno said the most important reason for dramatic changes in the forecast can be traced to better than previously anticipated occupancy rates.

“Given the developing trends, we moved up the time frame for demand recovery,” he said. “The easy comparisons to last year’s performance in the first three months will show significant demand improvements over 2009. With that will come a little stronger ADR growth.”

One aspect that shouldn’t be dismissed is that a positive atmosphere can produce some improvement, according to Lomanno.

“Pricing is as much about psychology as it is about facts,” he said. “When people see demand growth numbers in the 4, 5 or 6percent range for a few months, it will embolden them to increase ADR.”

Demand Side

Contrary to previous thinking, STR now believes demand growth will be stronger in 2010 than in 2011. The company said demand will grow 4.1 percent in 2010 and 2.9 percent in 2011. When STR crunches March 2010 data in the middle of April, it is expected that it will emerge as the fourth consecutive month to show demand growth.

“The recovery will slow down late in the fourth quarter of 2010 and in early 2011,” he said. “2.9percent demand growth in 2011 is nothing to sneeze at. It’s double the 20year average for demand growth (1.4 percent), but there are some external forces at work that have caused the demand cycle to be altered.”

Lomanno said the belief is that 2011 will be a much more cumbersome year tax wise than 2010, so companies will accelerate business as much as possible in 2010, recognizing they will pay more taxes in 2011 because of new government obligations.

“In this kind of recovery, the real engine that will propel it on an upward trajectory will be jobs growth, which hasn’t happened yet,” he said. “When job growth comes back, that’s when real demand growth will kick in.”

Lomanno said the Hendersonville based company expects group business to return to hotels by 2012 or 2013, but a portion of what it was during the peak years of 2006, 2007 and 2008 won’t ever return.

Supply side

STR projects supply to grow by 2.2 percent in 2010 (up from the previous forecast of 1.8 percent) and 1.0 percent in 2011 (the same as the previous forecast).

Lomanno said even during the deepest downturn in memory, hotel developers didn’t stop doing what they do.

“Hotel development is never done,” he said. “The conventional wisdom is that development dried up in 2009, but the reality is that the industry started construction on 35,000 rooms. We expect that to continue in 2010. “Even though this forecast is significantly better than last one, the supply growth actually went up. That’s not typical,” he said.

Adding to the problem is that few rooms are closing.

“Last year was the smallest number of rooms closing in a decade when you thought it should have been the highest,” Lomanno said. “The only things closing now are the billboard type properties. In ’04, ’05 and ’06 what was closing are little mom and pops that no one noticed. It’s a different kind of closing today, and the reality is that they are absolutely coming back into the supply at some point.”

STR’s updated forecast is a sign of the upanddown nature of the economy, Lomanno said. It also indicates there are better times ahead.

“Not only the worst is over, but there is improvement and maybe there will be some pricing power,” he said. “But we don’t have complete confidence that the industry will embrace that to the level it could until well into next year—when it could easily do it this year.

“The takeaway is that 2010 is going to be significantly better than (hoteliers) thought it would be, and they plan their strategies accordingly,” he said. “It won’t be back to 2007 or 2008 levels, and there will be easy (comparisons to last year). 2011 will be a good year on top of a good year, and that is something we haven’t seen in awhile.”